A large number of Indian textile orders are transferred to China

A large number of Indian textile orders are transferred to China, and under the epidemic situation, it still depends on Chinese manufacturing

High-tech innovation in the textile industry is the future development. According to multiple media reports, since September, a large number of textile orders originally handed to India have been transferred to China. Due to the severe epidemic situation in India, textile companies cannot start work normally and deliver on time. To alleviate their urgent need, international customers handed these orders to China for production.

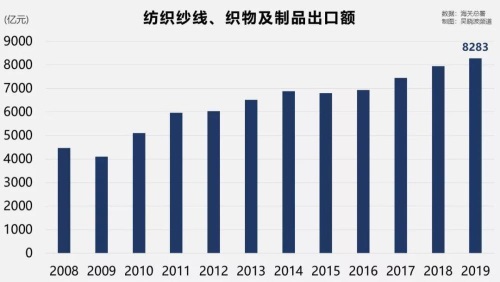

For example, ZARA, whose tablecloths were originally produced in India, were transferred to a home textile factory in Jinhua, Zhejiang in September this year. According to the 21st Century Business Herald, this order includes hundreds of thousands of tablecloths, accounting for 60% of the company's total output this year, and its revenue has skyrocketed five times over the same period last year. The trend behind this is worthy of our attention. For China, textile exports account for about 12% of total exports, and the number of employees in textile industry regulated companies accounts for about 10% of the national regulated companies. Whether it is "stabilizing foreign trade" or "stabilizing employment," the textile industry is an important position.

For India, the textile industry is equally important. In India, the textile industry is the second-largest industry after agriculture, creating more than 35 million jobs (Corporate Catalyst India). From 2018 to 2019, India's textile export revenue was close to 37.5 billion U.S. dollars, accounting for 11.4% of total exports (Televisory Analytics). In the past, many international brands of clothing and home textiles, such as E-LAND, Levi’s, Mark&Spencer, ZARA, etc., were OEM produced in China. However, with the transformation and upgrading of China's industry, the costs of manpower and materials have risen, and these companies have successively switched to Indian foundries. This year, the epidemic caused a large-scale shutdown of the Indian textile industry, unable to meet the large production demand, so the brand's orders returned to China. The Indian textile industry has suffered greatly as a result. As early as July, the Indian Textile Industry Association stated that due to the impact of the epidemic, the overall demand for this fiscal year will drop by 25%-50%, and a quarter of textile and garment factories will be permanently closed. The Indian Garment Manufacturers Association has also stated that without government assistance, 10 million people may be unemployed in the country’s textile industry chain. India is like this. Looking back at China, the surge in orders will bring much benefit to the Chinese textile industry? There is a view that China itself has a very complete supply chain, and once an overseas brand has reached a cooperation with a certain OEM, it is difficult to switch at will in a short time, so the benefits for the textile industry will continue for 2-3 years. However, there are also views that after the epidemic is over, orders should return to India, and the short-term recovery will not bring more benefits to the Chinese textile industry. It is worth noting that just as the Chinese media told the story of "the epidemic caused international textile orders to flow from India to China", the Indian media was telling another story at the same time-"Sino-US trade friction caused international textile orders to flow from China to India" s story. In fact, the textile industry has completely moved from China to India and other Southeast Asian countries, which is not very operability. Because Southeast Asia does have a comparative advantage in labor costs, but in some other supporting facilities, the combined costs may be greater than China. First, the delivery period in these places in India is long and the labor efficiency is not as high as in China. The same order will be delivered at least three weeks later than China. This has brought inventory backlog problems and increased cost pressures. The second is the transportation problem in countries such as India. India’s ports are heavily piled up all year round, and logistics is not as fast as China, so it is not as convenient as China in terms of commodity transportation. In recent years, some clothing industries may indeed have moved to Southeast Asia because of the large labor demand of clothing factories. However, our socks manufacturers have a high degree of automation and do not need to consider too much labor costs. If it is an industry like this, there is no need to move to Southeast Asia. And in recent years in Southeast Asia, for example, in Vietnam, labor costs are also rising, which is a trend. Therefore, their comparative advantage in labor costs is not lasting. In fact, the incident in India this time has not caused much disturbance in our industry, and it feels quite normal. The massive transfer of Indian textile orders to China is expected to last for two to three years. Because of the epidemic in India and the inertia of supply chain management, it is difficult for overseas companies to switch between producers at any time. But in the long run, the realization of high-tech innovation in the textile industry is the way of future development. In the short term, the cumulative number of new crown cases in India has exceeded 7 million. Local medical experts predict that India will surpass the United States to become the country with the largest cumulative number of cases in the world, and that the epidemic will be difficult to end in a short time. This caused great disturbance to the production environment in India. From the perspective of overseas companies, they have their own supply chain management, and the process does not allow them to switch between China and India at any time. After a stable production process is established, there will be no categorical changes without special reasons.

Now is a special situation. India is unable to deliver goods due to the epidemic, so these companies are forced to transfer their supply chains to China. Once transferred to China, these orders will be maintained for a period of time, even if Indian manufacturers say that they can take orders again, the switch will be a slow process. Because companies need to conduct careful inspections, if they have adapted to China's production system, including logistics, inspection, customs declaration and other processes, they are likely to keep their orders in China for a long time. Of course, the premise is that the company can finally accept China's costs. The textile industry is a very special industry because of its low barriers to entry. Like the production of home textile products such as towels and bed sheets, almost all countries have this production capacity. In recent years, as China's labor costs have increased, there is indeed pressure for industrial transfer. However, traditional industries are not necessarily low-tech industries. Combining high-tech with traditional industries is what China is good at. The textile industry is also undergoing technological innovation to achieve higher levels of automation to reduce costs. In addition to reducing costs, with the development of technology in this industry, the types of products produced are also changing. For example, through the application of 5G technology and high-end manufacturing, China can provide higher-level categories to meet higher-level needs. We have the ability to compete in market segments or create market segments. From this perspective, compared to India’s comparative advantage in labor costs, we have the comprehensive advantage of the technology management industry chain; and we can provide higher-tech and higher-end products at the same price. This is the long-term strategy for keeping orders in China. On the other hand, if the textile technology of India and other countries is strengthened and efficiency is improved, it will also pose a challenge to China.

But this competition cannot be seen as a difficulty for China's textile industry. Our textile industry has always had a very strong competitiveness, but to face competition, we must improve our technology management and industrial chain to overcome challenges. We have done a very good job in this aspect. We have transferred some low-end textile industries out because of industrial upgrading, which cannot be regarded as damage to the textile industry. For example, it turns out that Western countries transferred their manufacturing to China. This cannot be said to be the lack of competitiveness of Western companies, but that their companies have upgraded their industries, which is good for them. The same applies to Chinese companies. As for the biggest trouble for the textile industry in Jiangsu and Zhejiang in recent years, is it because of cost issues that other countries have "grabbed orders", and whether our textile industry has to rely on technological upgrading instead of competing with India and other places. I don't think we can look at it across the board. Because the products are diversified, in fact, products of different levels have different market-oriented products. High-end is certainly one of our competitiveness, but I think those traditional low-end textiles also have its market. If China does not have a price advantage in this respect, then we can develop a little bit less, but we cannot fail to develop at all. Under the dual-cycle pattern, we can also take advantage of labor-intensive industries that have relatively low added value. By cooperating with the inland, central and western regions to drive the inland economy, this is also a way for our Jiangsu and Zhejiang regions to expand, and it also responds to the call of the country.